Personal Treasury: Bitcoin-First Strategy

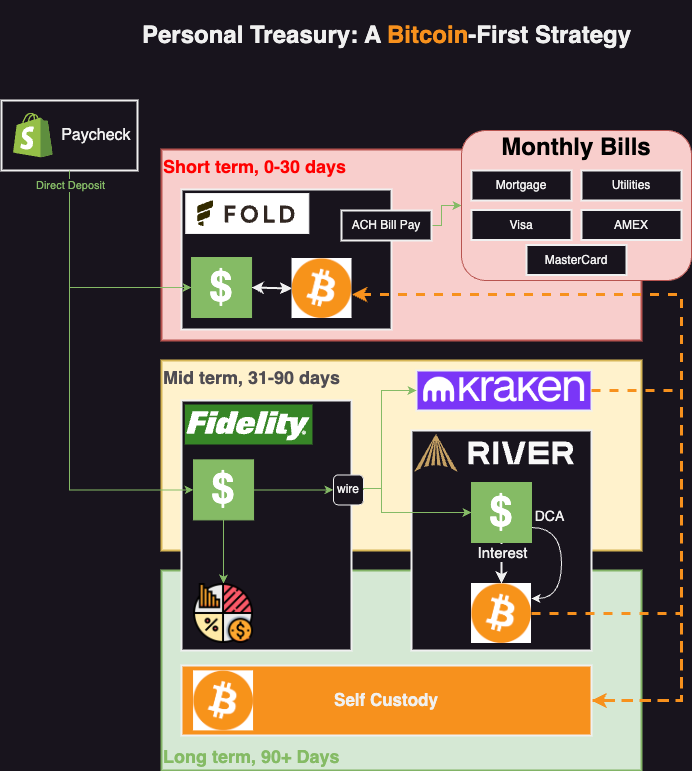

Managing personal finances in the bitcoin era requires a strategic approach that combines the best of traditional banking with modern bitcoin solutions. This post outlines a three-tier treasury system that optimizes for both fiat obligations and bitcoin savings.

The Three-Tier Structure

Short Term (0-30 Days)

The first tier handles immediate obligations and monthly expenses. Using services like Fold (or Strike), you can manage bill payments while earning bitcoin rewards. This tier covers:

- Mortgage/Rent payments

- Utility bills

- Credit card payments (Visa, AMEX, etc.)

- Daily expenses

The key here is maintaining enough fiat for monthly obligations while automating bill payments through ACH. Fold offers bitcoin rewards on spending, while Strike provides lightning-fast transfers. Choose based on your preference for rewards vs. transfer speed.

Mid Term (31-90 Days)

The middle tier focuses on intermediate savings and initial bitcoin accumulation. This layer typically involves:

- Traditional banking (e.g., Fidelity) for wire transfers

- Interest-bearing accounts for fiat holdings

- Dollar-cost averaging (DCA) into bitcoin

- Emergency fund maintenance

Services like River Financial combine traditional interest-bearing accounts with automated bitcoin purchases. This creates a seamless flow from fiat savings to bitcoin accumulation.

Long Term (90+ Days)

The final tier is dedicated to long-term wealth preservation through bitcoin self-custody. This involves:

- Regular transfers from your DCA strategy

- Hardware wallet storage

- Inheritance planning

- Cold storage solutions

Implementation Strategy

A three-tier approach to personal treasury management

A three-tier approach to personal treasury management

- Start with Income Segregation

Direct your income into appropriate tiers based on your expenses and savings goals. Typically:

- 20-40% for short-term obligations

- 40-50% for mid-term savings and DCA

- 10-40% for long-term self-custody

- Automate the System

- Set up automatic bill pay through Fold/Strike

- Configure regular DCA purchases

- Schedule periodic transfers to self-custody

- Monitor and Adjust

- Review monthly expenses and adjust allocations

- Optimize bitcoin purchase timing

- Regularly audit security practices

Risk Management

This system provides natural risk management through diversification:

- Short-term needs are always covered in fiat

- Mid-term savings earn interest while slowly accumulating bitcoin

- Long-term wealth is protected through self-custody

Final Thoughts

A personal treasury system should align with your financial goals while acknowledging the reality of living in a fiat world. This three-tier approach allows you to meet current obligations while systematically building bitcoin savings.

The beauty of this system lies in its flexibility. You can adjust percentages based on your circumstances, swap service providers (like using Strike instead of Fold), and modify time horizons to match your needs.

Remember: the goal isn’t to completely eliminate fiat, but to optimize its use while building long-term wealth through bitcoin. Start small, adjust as needed, and stay consistent with your strategy.

Have you implemented a similar system? Share your experiences in the comments below.